From Berkshire to Boston Omaha, The Buffett Bloodline Continues on...

A Deep Dive on Boston Omaha Corporation

Introduction

Welcome to my second newsletter, but first deep dive. In this writeup I will be going through the Boston Omaha Corporation. If you have any further questions, you can email me at mitch15jensen@gmail.com or DM me on Twitter @mitchjensen_. Thanks, and hope you enjoy!

Boston Omaha is an interesting company that has been quoted as the “Baby Berkshire,” both for the quality of management and the company. Firstly, Boston Omaha is a holding company that operates three separate lines of business: outdoor billboard advertising, surety insurance and related brokerage activities and broadband services. In addition, they hold minority investments in commercial real estate management and brokerage services, a bank focused on servicing the automotive loan market, and a homebuilding company with operations located primarily in the Southeast United States which has similar characteristics to NVR Inc. Boston Omaha (BOMN) is run by Co-CEO’s Adam K. Peterson and Alex B. Rozek. The interesting thing with Alex is that his middle name is Buffett as he is the grand nephew of Warren Buffett the Chairman and CEO of Berkshire Hathaway. Both Adam and Alex have the attributes of a young Buffett. Starting with their capital allocation skills as well as buying businesses that are quite easy to comprehend. The Co-CEO duo has done a great job allocating capital into businesses that are throwing off great returns, starting from the DFH position which was a 10 bagger in 3 years. Needless to say, these two managers are either lucky or talented, and I am betting on the latter.

Boston Omaha’s Holdings

Link Media Outdoors: Link Media Outdoor is an Out of Home advertising company, focusing on static vinyl and digital billboards, in mid and large sized markets, across the United States.

In June 2015 Boston Omaha, commenced a billboard business operations through acquisition by their wholly-owned subsidiary Link Media Holdings, LLC, which I will refer to as "Link." During July and August 2018, BOMN acquired the membership interest or assets of three larger billboard companies which increased their overall billboard count to approximately 2,900 billboards. Along with the 2,900 billboards Boston Omaha has made additional billboard acquisitions on a smaller scale since then. As of March 2021, they operate approximately 3,200 billboards with about 6,000 advertising faces across 12 states of which 60 were digital.

“We believe that we are a leading outdoor billboard advertising company in the markets we serve in the Midwest. One of our principal business objectives is to continue to acquire additional billboard assets through acquisitions of existing billboard businesses in the United States when they can be made at what we believe to be attractive prices relative to other opportunities generally available to us.” (2020 Boston Omaha Annual Report)

The majority of Link’s customers come from small business owners as local businesses account for close to 95% of Link’s revenue.

“2020 was a quiet year for acquisitions at Link but a busy year in building the business. Scott LaFoy exceeded all expectations as CEO as he navigated the pandemic which cratered advertising spend broadly in the first half of the year.” (2020 Boston Omaha Annual Letter)

I see Scott LaFoy as a great manager as Link’s 2020 revenues declined by 4.7% while expenses decreased 3%. Compared to the largest publicly traded out of home advertising companies lost between 10-30% in revenue for the year.

“Most of our expense reductions were a direct result of this realignment to give general managers more autonomy and align incentives, not temporary cost cuts. Therefore, as we have seen demand return in many of our markets, Link has also enjoyed the incremental profitability from all the hard work done by Scott and his team. We also have a relentless focus on reducing land costs whenever possible. In 2020 through easement purchases, greenfield developments and other reductions, we were able to realize a cost savings of nearly a quarter million dollars annually. As land costs are one of the largest expense line items in out of home advertising, pushing constantly to permanently reduce that cost pays off for years to come.” (2020 Boston Omaha Annual Letter)

The outdoor advertising industry in the United States consists of several large companies, and three companies, Clear Channel Outdoor Holdings, Inc., Outfront Media, Inc. and Lamar Advertising Company, own a majority of all outdoor billboards. These companies are estimated to generate more than 50% of the industry’s total revenues and several industry sources estimate that there are many other smaller companies serving the remainder of the market, providing a potentially significant source of billboards which may be acquired in the future. Part of Boston Omaha’s strategy is to acquire certain smaller and medium sized competitors in markets where they deem desirable to advertisers. BOMN also competes with other advertising media in our respective markets, including broadcast and cable television, radio, print media, direct mail, online and other forms of advertisement. Outdoor advertising companies compete primarily based on their ability to reach consumers, which is driven by location of the display.

In conclusion, Link Media is Boston Omaha’s largest business by capital invested, revenue and cash flow. I as well as BOMN’s management continue to believe billboards are an attractive fit for Boston Omaha. The billboards BOMN holds have similar qualities (1) they earn a favourable return on tangible equity capital, (2) cash flow generally grows at a higher rate than the incremental capital investment required, and (3) growth can go on for a long time if out of home advertising continues to take more share or marketing dollars, while new supply of billboard faces is limited within the market.

Table from the 2020 Boston Omaha Annual Letter of Link’s progress since 2015:

($ in millions) 2020 2019 2018 2017 2016 2015

Revenue $28.3 $28.4 $14.1 $5.3 $3.2 $0.7

Land Cost %7 21.7% 21.9% 21.3% 26.7% 17.3% 16.1%

Overhead %8 9.3% 9.6% 14.9% 16.7% 17.4% 15.1%

Net Working Cap $3.2 $2.8 $3.1 $0.8 $0.6 $0.2

Tangible PP&E, Net $35.1 $36.7 $41.6 $9.1 $5.6 $4.2

(2020 Boston Omaha Annual Letter)

The outdoor display market is attractive due to the high regulatory barriers to building new billboards in most states, the growing demand on advertising as well as the low maintenance capital expenditures for static billboards (regular billboards that you’d see everyday), low cost per impression for customers, and the potential opportunity to employ more capital in existing assets at reasonable returns in the form of perpetual easements and digital conversions. In addition, unlike other advertising industries, the internet has not had a material adverse impact on outdoor advertising revenues. Revenues for out-of-home advertising have continued to rise over the past several years, in contrast to print and other non-internet based advertising. The billboard industry’s three largest companies are estimated to account for more than 50% of the industry’s total revenues, and several industry sources and our experience suggest that there are a large number of other companies serving the remainder of the market, providing a potentially significant source of billboards which may be acquired in the future. Personally, I see the outdoor display market to have a wide moat as long as there is traffic, which I do not see driving coming to a halt anytime in the near future. Some would portray a potential risk with online advertising through social media, websites and browsers, but I believe there is more than enough room for both the outdoor display and online advertisement industry as everyone will be fighting for attention wherever they can get it.

General Indemnity Group: General Indemnity Group is a surety insurance company serving all 50 states and Washington D.C.

In September 2015, BOMN established an insurance subsidiary, General Indemnity Group, LLC, which I’ll refer to as “GIG,” designed to own and operate insurance businesses generally handling high volume, lower policy limit commercial lines of property and casualty insurance. In April 2016, Boston Omaha’s surety insurance business began with the acquisition of a surety insurance brokerage business with a national internet-based presence. In December 2016, they completed the acquisition of United Casualty and Surety Insurance Company also known as “UCS,” a surety insurance company, which at that time was licensed to issue surety bonds in only nine states. Since that time, UCS has expanded the licensing to all 50 states. Over the past four years, they have also acquired additional surety insurance brokerage businesses located in various regions of the United States.

How Surety Insurance works…

Surety insurance is an arrangement where three parties are involved; the surety, the obligee, and the principal. The insurance company provides a guarantee of their customer’s obligations to another party for a fee. The surety business is very different from a regular insurer as the surety business puts all the risk onto the party taking out the surety bond where as in a regular insurance business, the risk is all on the business. Here is a diagram which explains the differences between a surety bond and regular insurance:

Surety bonds are highly regulated by state insurance departments. Surety is designed to prevent a loss. Though some losses do occur, surety premiums do not contain large provisions for loss payment. The surety takes only those risks which its underwriting experience indicates are reasonable to assume based on its underlying experience. This service is for qualified individuals or businesses whose affairs require a guarantor such as a contractor. The surety views its underwriting as a form of credit, much like a lending arrangement, and places its emphasis on the qualifications of the prime contractor or subcontractor to fulfill its obligations successfully, examining the contractor’s credit history, financial strength, experience, work in progress and management capability. After the surety assesses such factors, it makes a determination as to the appropriateness and the amount, if any, of surety credit.

The surety market is $6.9 billion, based on 2019 industry reports. Most surety companies, in turn, distribute surety bonds through licensed surety bond producers, licensed business professionals who have specialized knowledge of surety products, the surety market, and the business strategies as well as underwriting differences among sureties. A bond producer can serve as an objective, external resource for evaluating a construction firm’s capabilities and, where necessary, can suggest improvements to help the construction firm meet a surety company’s underwriting requirements. Bond producers compete based on their experience, reputation, and ability to issue bonds on behalf of sureties. In addition to acquiring UCS, BOMN has acquired four surety brokerage firms, The Warnock Agency, Inc., Surety Support Services, Inc., Freestate Bonds, Inc., and South Coast Surety Insurance Services, LLC. UCS and these brokerage firms provide Boston Omaha with both premium and commission revenue streams.

Management on how GIG did through Covid-19:

“Some municipal and state governments signaled a sudden willingness to rewrite insurance contracts essentially forcing insurance companies to potentially take risks on their balance sheet they had not priced when selling their policies. Thankfully, this did not happen to any of our policies directly; however, where we felt we no longer understood the risks, we decided to no longer write new bonds, particularly in the residential apartment rental market.”

“In addition, there was a significant overall decline in business activity. Contractors of all kinds halted projects for months. All variety of trades that operate requiring bonds, from courts to security guards to cleaning crews, sat idle while office buildings were vacated, and many made the transition to work virtually.”

“Our choice in favor of conservatism in underwriting, coupled with a general decline in overall business activity, resulted in a significant reduction in the net written premium for the year.” (2020 Boston Omaha Annual Letter)

Personally, I see that it is quite evident that management is very focused on downside protection, which is one of the number one things I look for in a management team along with being candor.

GIG operates in an environment that is highly competitive and very fragmented. They compete with other global insurance and reinsurance providers, including but not limited to Travelers, Liberty Mutual, Zurich Insurance Group, Lloyds, and CNA Insurance Group, as well as numerous specialist, regional and local firms in almost every area of their business. These companies may market and service their insurance products through intermediaries, or directly without the assistance of brokers or agents. GIG also compete with other businesses that do not fall into the categories above that provide risk-related services and products.

Initially, management was not interested in using GIG as an investment vehicle.

“In October we commenced operations at our subsidiary General Indemnity Group, for the purpose of underwriting specific types of insurance risk. To be clear, we have not written one dollar of premium to date, however; we plan to prospect in some potentially attractive niches of commercial insurance. While doing so, we recognize this is an ultracompetitive field and there can be no certainty of success. At a high level, here is our approach. General Indemnity will be an underwriting and distribution operation first, not an investment operation masquerading as an insurance company. It has no pressure from management to grow premiums at a predetermined rate, no legacy liabilities to pay, a president with a general disposition to favor patience over action, no asset management arm to draw fees off it, and for better or worse, a clean slate in terms of its distribution model.” (2015 Boston Omaha Annual Letter)

Management has since changed their mind and has decided to use GIG as an investment vehicle much like Buffett and Berkshire Hathaway.

“As a quick refresher on how we look at GIG, we can bisect the business into insurance operations and, as we have grown, a small portfolio of investments. By far, our focus has been and continues to be insurance operations. Therefore, we will discuss the insurance business first, reviewing both distribution and underwriting.” (2020 Boston Omaha Annual Letter)

“Throughout much of the surety landscape, these two halves of the whole operate in their own silos, with neither having true transparency into the costs of the other. We believe that better underwriting selection and a relentless focus on reducing the cost to produce these bonds will allow the business to take share overtime by providing a valuable service to its customers at a competitive price.”

“Below is a table of the business that UCS produced each year broken out by the gross written premium, which includes surety that was produced by non-GIG agents and GIG agents, and controlled premium, surety that was produced all inhouse.”

($ in millions) 2020 2019 2018 2017

Gross Written Premium $8.3 $14.6 $7.3 $2.3

Controlled Premium $4.3 $4.9 $2.8 $1.5

“The gross written premium decline of over 43% had mainly to do with our own decision to discontinue writing certain bonds in the apartment rental market.” (2020 Boston Omaha Annual Letter)

“At the end of 2020, UCS held admitted assets of $40.6mm. The chart below is a breakdown of the composition of UCS’s assets at the end of each year.”

2020 2019 2018 2017

Cash 61.5% 34.4% 72.9% 62.6%

Bonds 7.0% 17.6% 20.2% 34.6%

Stocks 28.0% 43.3% - -

Other 3.5% 4.7% 6.9% 2.8%

Total Admitted Assets 100.0% 100.0% 100.0% 100.0%

(2020 Boston Omaha Annual Letter)

I believe surety insurance to be a great business as the party taking out the bond doesn’t want to default on it as they will have to pay back the money the insurer paid the obligee if the party was to default. Where as in the auto insurance for example, the customer is glad that they are able to use the money from the insurance company to purchase a new car after damaging their own and in turn, are not financially taking on the risk.

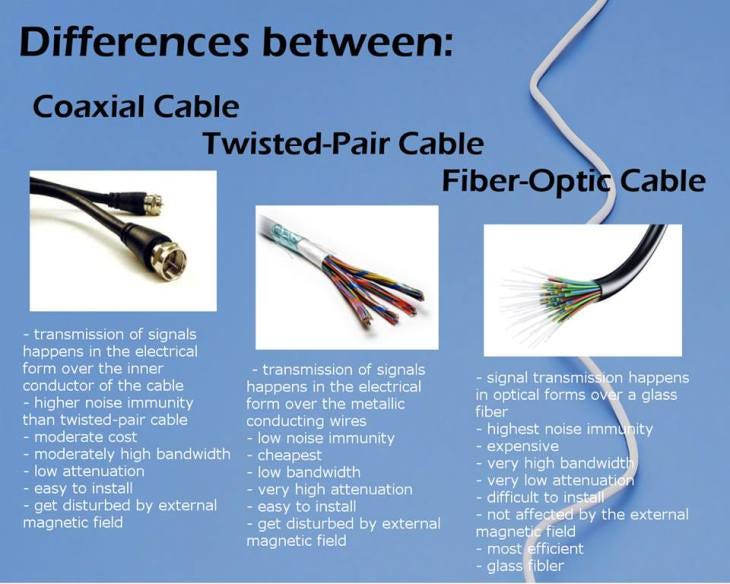

AireBeam & Utah Broadband: Together, AireBeam and Utah Broadband provide fiber connectivity to homes, business and community organizations in certain markets in Arizona and Utah. Driven by both the rising demand for higher bandwidth, and faster speed connections for a variety of industrial and residential purposes, fiber optic transmission is becoming much more common in today’s age. The advantage fiber optic cables have over metal cables is the much greater bandwidth it has. Which for those that are new to the broadband industry, bandwidth is the maximum amount of data transmitted over an internet connection in a given amount of time.

Here are some differences of fiber optics compared to others:

The advantages of fiber optic is the significantly higher amount of information that can be transmitted per unit time of fiber over other transmission media. Also, an optical fiber offers low power loss, which allows for longer transmission distances. Fiber optic is generally less susceptible to electromagnetic interference, has greater capacity and weighs less than traditional metal wire connections. Also, fiber optic is made of glass, which can provide certain cost advantages over traditional copper wire. Optical fiber is more difficult and expensive to install than copper wire and special equipment is required to test optical fiber. Fiber optic is also highly susceptible to becoming cut or damaged during installation or construction activities. We believe that the demand for broadband services has increased significantly since the COVID pandemic began and that this demand will continue to grow as more businesses and consumers rely on remote connectivity for work, learning, telehealth and other connectivity needs and as new technologies expand the ability to digitally share information and services.

How Boston Omaha structured both the AireBeam and Utah Broadband acquisition was quite interesting. Both founders were still interested in running their businesses, so Boston Omaha owns 90% of AireBeam, and the founder Gregory Friedman was able to keep 10% ownership. Boston Omaha owns 80% of Utah Broadband which the founder Steve McGhie still owns 20% of it. AireBeam’s founder, Gregory Friedman has since retired at the age of 77 years old, and Bernie Reynoso and Scott Sampson have been appointed interim Co-CEOs.

I see the fiber to the home business as a great business. The approach of both companies is interesting because existing wireless customers in a neighborhood are a great jumping off point for a fiber network build. Where it would be impractical to install additional radios in certain areas, passing your own customers’ homes with fiber allows you to pass other homes as well, picking up additional customers that appreciate having the best quality internet service possible.

There is no real competition for AireBeam and Utah Broadband because they operate in rural areas, where the bigger companies in the industry don’t want to go because they are focused on the more populated areas for obvious reasons.

Why fiber to the home is great…

“When it comes to broadband internet, we believe there isn't a better product than fiber. Copper speeds top out around 1 Gbps and various cable modems can get up to 10Gbps. Remember, these speeds may sound fast compared to what is sold, that is because they have to be shared among a number of users across a network, and in every case, the upload speeds are far less than the download speeds.”

“Fiber can transmit around the same amount of data that can be transmitted over copper, per wavelength of light and with the tremendous number of wavelengths of light traveling both ways along a single strand of fiber, the resulting data throughput can be more than 100 times what is available on the fastest cable network. In addition, fiber carries that amount of data symmetrically up and downstream.” (2020 Boston Omaha Annual Letter)

Fiber just seems like the better option as it is substantially faster which makes all the difference in a world where we eat breath and sleep on the internet. From communicating over Zoom, to watching Netflix, to working from home. Fiber makes internet life a lot faster and easier than any other.

Management really likes fiber to the home and they see that it is similar to putting in electricity into homes 100 years ago. “We view the opportunity to lay fiber to the home much like the opportunity to electrify homes nearly a hundred years ago. And we are not alone in this perspective, our competitors see the opportunity too, so there is no time to waste in putting fiber in the ground and on the pole to reach as many customers as possible for that last mile.” (2020 Boston Omaha Annual Letter)

Boston Omaha’s broadband businesses are now working with Dream Finders Homes (DFH). I will explain more about DFH later in the writeup. They have begun working on some greenfield projects with Dream Finders Homes to build fiber to their new home builds. “We believe this is a win for both parties as new homeowners are often surprised to discover that they have to call a cable company to come and hook their home up to the network after it has been built. In our homes, the customers walk in day one to a house of the future, fully installed with the most dependable and affordable high-speed broadband that can easily scale up to meet their needs.” (2020 Boston Omaha Annual Letter)

The fiber to the home business is a great fit for Boston Omaha in my opinion. It takes significant capital upfront, the skills of experienced engineers and broadband business owners to execute the business plan and should benefit from a forever-home with no sell by date. It is also a business that is fairly understandable, as it provides a valuable benefit to customers at a competitive price and a service for which I believe demand will continue to increase for many years to come.

In the future, leading cable operators, such as Comcast, Charter Communications and Altice USA, as well as other competitors may seek to enter the markets that serve. In addition, AireBeam and Utah Broadband may face competition from 5G in the home and other services incorporating new technologies. Technological changes are further intensifying and may challenge existing business models. Their internet services are expected to compete with wireless phone companies, satellite and other broadband providers as well as wireline phone companies and other providers of wireline internet service and others seeking to build fiber-based network infrastructure.

I am still unsure if that is a competitive advantage as I would be hard pressed to think someone would pick one house over another just based on the fact that DFH homes have already installed broadband. But, obviously it isn’t something that would shy away a customer.

Fiber to the home seems to be growing business as well as a necessity in todays world. High-speed broadband is something that a customer realizes they need only when they don’t have it. I personally have heard hundreds of times peers say “the wifi’s slow in here,” and can understand how frustrating it is especially for people working from home.

Minority Investments

Dream Finders Home: Dream Finders Homes (NASDAQ:DFH) is a national home builder committed to helping buyers have a unique experience by personalizing each home to fit their lifestyle while also offering quality and affordability. DFH is very similar in the way that NVR operates where they use options contracts on the land. Adam and Alex did an exceptional job with the DFH investment. Boston Omaha purchased a $10,000,000 stake in 2017 when it was still private. This is how the DFH investment went. “On January 25, 2021, DFH completed its initial public offering and our $10 million investment in DFH common units was converted into 4,681,099 shares of Class A common stock of DFH and one of our subsidiaries purchased an additional 120,000 shares of DFH Class A common stock at $13.00 per share in the initial public offering. The shares acquired from our 2017 investment in DFH are subject to a lockup which expires on July 19, 2021 and, due to our ownership of more than 10% of the Class A common stock of DFH, we are subject to volume trading limitations imposed by Rule 144 under the Securities Act, which can limit the number of shares of DFH Class A common stock we can sell in any 90-day period, which limitation will remain in place until such time as we are no longer deemed to own 10% or more of the Class A common stock of DFH. At March 26, 2021, our total investment in DFH, based on its closing price on such date, was valued at over $111 million. Any decrease in the value of DFH common stock before we can liquidate our holdings in DFH could materially adversely impact our operating results and our stockholders’ equity.” (2020 Boston Omaha Annual Report.)

I believe DFH to be a great business, but as of right now, have no clue whether it is over or undervalued. I believe the intrinsic value of the investment which is valued at $111 million to be between $60 - $125 million.

Logic Real Estate and 24th Street Asset Managment: Logic Commercial Real Estate is a full-service firm specializing in Brokerage, Property Management, Capital Markets, and Receivership Services.

Since September 2015, Boston Omaha has made investments in commercial real estate, a commercial real estate management, brokerage and related services business as well as an asset management business. BOMN currently owns 30% of Logic Real Estate Companies LLC, and approximately 49.9% of 24th Street Holding Company, LLC, both directly and indirectly through our ownership in Logic. In addition, we have invested, through one of our subsidiaries, an aggregate of $6 million in 24th Street Fund I, LLC and 24th Street Fund II, LLC. These funds are managed by 24th Street Asset Management, LLC, a subsidiary of 24th Street Holding Co. and will focus on opportunities within secured lending and direct investments in commercial real estate.

CresentBank: In May 2018, BOMN invested, through one of their subsidiaries, approximately $19 million through the purchase of common stock of CB&T Holding Corporation, the privately-held parent company of Crescent Bank & Trust, Inc., which I’ll refer to as “Crescent.” Crescent is located in New Orleans and generates the majority of its revenues from indirect subprime automobile lending across the United States.

Yellowstone Acquisition Company: Boston Omaha’s management has often discussed their appreciation of working with owner operators which I enjoy hearing as I am a big fan of Nick Sleep from Nomad Investment Partnership which also looked for owner operators. Yellowstone Acquisition Company was formed for the exact purpose of looking for a quality owner operator to take public and hopefully be a long-term compounder.

“In October, we raised $136mm in an IPO for this special purpose acquisition company (often referred to as a SPAC) with the goal of creating a business combination with a company that would otherwise be too large for our typical minority investment.” (2020 Boston Omaha Annual Letter)

Management is interested in looking at anything as long as it is not in the billboard, surety insurance or broadband businesses, as those would compete directly with Boston Omaha, the sponsor.

Yellowstone's initial business combination must occur on or before January 25, 2022 with one or more target businesses that together have an aggregate fair market value of at least 80% of the net assets held in the trust account.

Boston Omaha has a 20% ownership in the SPAC that they refer to as the Yellowstone IPO. This is interesting as with a lot of companies that are doing SPAC’s nowadays since they have gained popularity. Most other companies that are in the SPAC craze don’t have a substantial amount invested into their SPAC, which for example if the SPAC was to work out well, the investment wouldn’t really “move the needle” per say. Where as with Boston Omaha has just under $28 million invested into the Yellowstone SPAC which represents 3% of its market cap.

Management

Executive Management

Adam K. Peterson - Co-Chief Executive Officer

Adam is the founder of The Magnolia Group LLC as well as holds the position of Co-Chairman, Co-President, and Co-CEO at Boston Omaha and Yellowstone Acquisition Co. He is also on the board of Nicholas Financial, Inc. and Brampton Brick Ltd., which The Magnolia Group has a position in both companies.

Alex B. Rozek - Co-Chief Executive Officer

Alex is Co-Chairman, Co-President & Co-CEO at Boston Omaha and Yellowstone Acquisition Co., President of FIF Utah LLC (a subsidiary of Boston Omaha Corp.), as well as Investment Manager at Boulderado BOC LP. He is also on the board of Spencer Capital Holdings Ltd. and Manager at Boulderado Capital LLC.

Joshua P. Weisenburger - Chief Financial Officer

Joshua is Chief Financial Officer, Secretary & Treasurer at Boston Omaha Corp. and Chief Financial Officer, Secretary & Treasurer of Yellowstone Acquisition Co.

Board of Directors

Adam K. Peterson - Co-Chairperson of the Board

Alex B. Rozek - Co-Chairperson of the Board

Brendan J. Keating - Manager and CEO of Logic Commercial Real Estate, LLC

Brendan occupies the position of Chief Executive Officer & Manager at Logic Commercial Real Estate LLC. He is also on the board of Boston Omaha Corp. and TAG Las Vegas Boulevard LLC.

Bradford B. Briner - Co-Chief Investment Officer at Willett Advisors, LLC

Frank H. Kenan II - Co-Founder and Principal of KD Capital Management, LLC

Frank founded KD Capital Management Llc, which he currently is the Principal there. He is also on the board of Boston Omaha Corp., Flagler System, Inc. and The College of Charleston Cougar Club.

Vishnu Srinivasan - Chief Investment Officer at The Ohio State University

Vishnu is on the board of Boston Omaha Corp. as well as The Pritzker Traubert Family Foundation and Chief Investment Officer of The Ohio State University.

Jeff Royal - Owner, President at Dundee Bank

Jeffrey occupies the position of Chairman of Nicholas Financial, Inc., Chairman for Mackey Banco, Inc., President of Dundee Bank (Omaha, Nebraska) (a subsidiary of Mackey Banco, Inc.), Vice President-Operations for MIRUS Information Technology Services, Inc. and Non-Executive Chairman for Eagle State Bank. Jeffery is also on the board of Bridges Investment Fund, Inc., Boston Omaha Corp. and Brunswick State Bank (Nebraska).

It is evident that some of the board of directors are much more connected than just being on Boston Omaha’s board, as a few are on other boards together such as Nicholas Financial. Now, I am neither saying that this is a positive or a negative, you should add your own judgment to it, but I do see the added benefit of having a closely knit board.

Management has significant ownership in Boston Omaha as seen below:

Management owns 43.3% of the Class A shares and 100% of the Class B shares. Which puts the percentage of aggregate economic interest of Class A and Class B common stock at 45.71% and 60.72% of the voting power.

Conclusion

Thank you to those who have read as of this far. As you can probably tell, I like Boston Omaha based on management as well as I think the business operations are top notch. I see the business to be fairly valued where it is today at a market cap of $900 million ($30/share). I would be interested to hear what others believe the intrinsic value to be. So, if you’re interested in talking BOMN, email me at mitch15jensen@gmail.com or DM me on Twitter @mitchjensen_. Full disclosure, I do own Boston Omaha, and I am looking to add to my position upon further digging to see if there is potentially hidden value. As of now, I think buying Boston Omaha below $25 a share is great and below $20 a share as an exceptional deal!

My next writeup will be about the Tobacco industry and discuss the different players in the industry. Stay tuned for that deep dive on the industry!

Disclosure

Everything written in this newsletter is NOT investment advice, it is for entertainment and educational purposes only. I may or may not have a position in the securities I mentioned, but it does not mean that I am recommending them to you. I am simply stating what I have learned and reiterating it through this newsletter. Thank you.

Links

Link to Boston Omaha’s website: https://www.bostonomaha.com/

Here is a link to our latest podcast where we talk to Investing with Tom about Seritage Growth Properties and Alibaba.

A few great video’s on Boston Omaha Corporation are:

Matthew Frankel, CFP from the Motley Fool summarizes Boston Omaha in a 5 minute video which may help connect ideas:

Great video from Elias from the Investing Club YouTube channel

Thanks for putting this together. I bought back when it was 15.. He got a large amount of of his personal holdings tied up in this company..