Welcome To My Portfolio...

A brief walkthrough of my holdings.

Introduction

I’ll start my first newsletter off by introducing myself. My name is Mitch, you may know me from the Money Under the Mattress Podcast, or you may be brand new and have no clue who I am. Well, I am 20 years old and have been investing since I was 13. For the last year and a half, I have been reading up everything I can find on investing, moreover value investing. I started investing at a fairly young age when I saved up my first $1,000 and invested into a diversified mutual fund. Once I started to get older and read more about Warren Buffett, I realized that I would enjoy investing my own money and picking my own stocks. My first stock that I bought was a severely overpriced cannabis company that was debt ridden and diluting shareholders quite drastically. My initial $2,000 dollars that I invested into this business quickly turned into almost $0. That was my first “hard” lesson I learnt as a young investor, “do not listen to the crowd,” as well as “understand the business you are investing in.” After my learning lesson I took some time away from the market to start researching more about the different types of strategies that there are in investing. I saw the “$0 to $1,000,000 in One Year from Day Trading” videos on YouTube that suck in a lot of early misguided young investors. They amused me but I still didn’t understand why a person would make YouTube videos and sell courses if they are able to make “millions” from day trading. That was when I met a buddy in college, which is now my business partner and other co-host of the Money Under the Mattress podcast, Jake McAdam. Me and Jake had similar interests and wanted to make money passively. We started a few ventures where we would flip items from Alibaba onto Facebook Marketplace, sell sports betting ideas on Instagram, as well as selling men’s shoes online (which didn’t work out well). Then we met a guy in our class named Mark. Mark caught our attention when on his first day he went up to our accounting teacher to notify him about his portfolio being up a few percent that day when all other indices were down quite a few. That was the first time I ever heard someone say, “I have a few Out-of-the-Money Call Options on the Vix.” Seemed like a lot of gibberish to Jake and I, but we were intrigued enough to listen to Mark and allow him to explain more about options trading to us over lunch. By end of day, me and Jake realized that options was not something we were interested in and decided to look more into how Warren Buffett invests. I saw on a website that Buffett recommended reading the Intelligent Investor. After reading that, I decided to read a few other books on investing (Rule 1, One Up on Wall Street, and Common Stocks and Uncommon Profits.) When I read Benjamin Graham talk about “margin of safety” and “Mr. Market” it all made sense to me. A stock is a business and not a piece of paper that is traded around, buying a $1 for $.50, and Mr. Market is an irrational guy at times so there is some inconsistency in the market if you look long and hard enough made just as much sense as one foot in front of the other. The more I read about value investing and Buffett the more I was hooked. After researching more, I came across a guy that many know, Mohnish Pabrai. I decided to pick up Mohnish’s book The Dhando Investor and wanted to learn more from Mr. Pabrai. I took a couple weeks to watch a few of his talks each day until I was caught up to his latest ones. His strategy of “heads I win, tails I don’t lose much” stuck with me as well as his new strategy of buying long-term compounders.

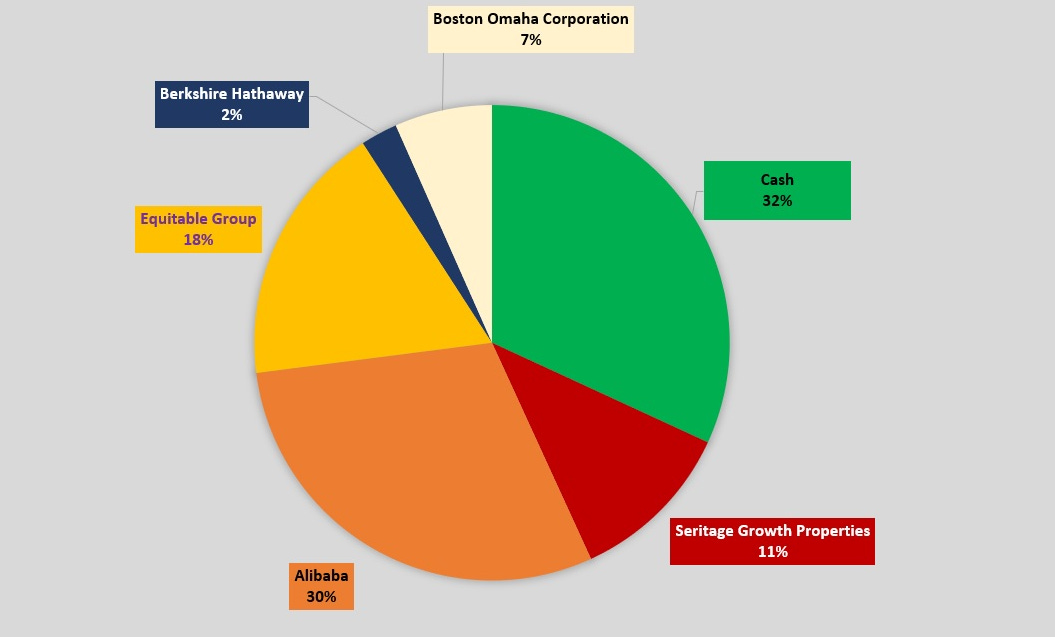

Today, my portfolio is built up of five positions where my top 3 holdings make up 60% of the portfolio. I feel that by not heavily diversifying and placing big bets on my great ideas, and placing smaller bets on my good ideas gives me an advantage over the 100+ stock portfolio that most people are invested in.

How I think of My Portfolio

I like the idea that Adam Mead has presented on his YouTube channel, here is a link if you have not watched it.

The video is about how he thinks of his portfolio as a deck of cards. A regular deck of cards has four aces and four kings. He explains that in his portfolio he has 3 aces (great ideas), and 2 kings (good ideas). He states that he is looking through the other 47 cards (52 cards in a deck minus the 3 aces and 2 kings) for that final ace where he can allocate capital to. I like to think that I have 2 pristine aces, 2 kings, and a third ace that is not pristine. It is a worn-out ace but with a little correction of its errors and a touch up with some paint that ace will become the third pristine ace. In my analogy I like to think that third ace to be in someone else’s hands getting worked on. I don’t know when I will be getting it back, all I know is the potential for it. That holding would be my 3% position in Berkshire Hathaway. I will discuss Berkshire’s business later in this newsletter. My position in Berkshire is much lower than I would like it to be. When I bought Berkshire, I had a third of the capital I have now in the portfolio. Buying Berkshire at $220 and taking a 10% position was something a lot did at the time and didn’t take a ton of thinking to make a decision like that. But when running a decent sum of money now and realizing that I must bet bigger on great businesses when the opportunity presents itself, that opportunity meaning a margin of safety. It is difficult to see Berkshire as a pristine ace for now as it is fairly valued in my opinion and doesn’t give me great room for error. For now, I am happy waiting for Berkshire to come down in price, and if it does not, then I will be a proud Berkshire shareholder that does not have a meaningful amount invested in them.

The Portfolio:

As of the today July 8th, 2021 when I am writing this the portfolio is made up of the following:

- Alibaba (BABA) – 30%

- Equitable Group (EQB.TO) – 18%

- Seritage Growth Properties (SRG) – 11%

- Boston Omaha Corporation (BOMN) – 7%

- Berkshire Hathaway (BRK.B) – 2%

- Cash – 32%

This will just be a brief description of the each of my holdings. I will go through when I initially purchased the business and will detail my quick synopsis on my ideas.

Alibaba (BABA)

Stay tuned for my Alibaba thesis. Make sure you subscribe so you are notified once released.

Equitable Group (EQB.TO)

Equitable Group is the 9th largest bank in Canada. Its primary business is residential and commercial real estate lending. Equitable Group also has a high interest savings account that currently pays a 1.25% interest rate, which is one of the greatest rates of all Canadian banks.

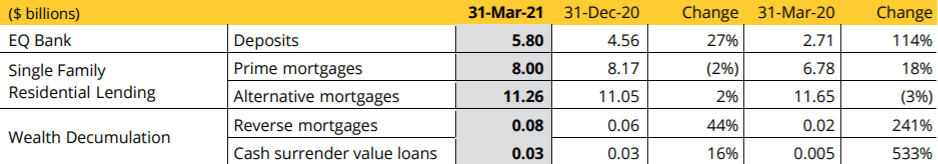

Numbers are as of March 31st, 2021.

Personal Banking:

As you can see, Equitable Group is growing significantly in 4/5 businesses presented here.

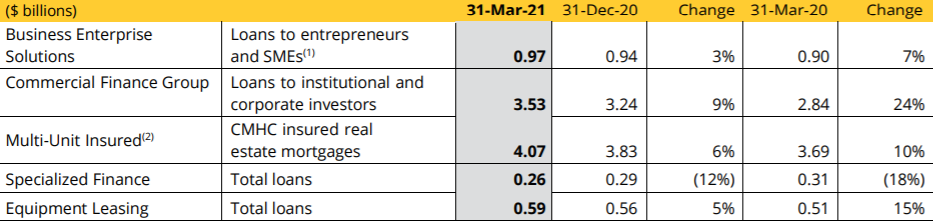

Commercial Banking:

Below is the Q1 2021 (March 31st, 2021) earnings information:

Q1 Net Earnings $69.2 Million +$43.2 Million from 2020

Q1 diluted EPS $3.97, +172% from suppressed levels in Q1 2020 at the onset of COVID-19

ROE, Book Value, Efficiency Demonstrate Structural Advantages

Q1 ROE 17.1%, +9.9% from Q1 2020 and above target of 15-17%

Book value +19% y/y or $15.86 to $97.86 per share (and +5% or $4.51 from Q4 2020)

Efficiency ratio 38.2%

High-Quality Asset Growth with Industry-Leading Efficiency

Loans under management +9% y/y to $34.2 billion, (and +2% from Q4)

Total loan originations +39% y/y to $2.7 billion, Commercial +52% y/y and Personal +28%

Reverse mortgages +44% q/q and 241% y/y

Equitable Group is selling at under 9x earnings currently. I started buying EQB.TO when it was selling at 6x current earnings, and have added since then. I believe that Equitable Group should be at least selling at 15x current earnings based on both the quality and future growth for the business. The top six banks in Canada are all selling at about 11x earnings with minimal growth potential. If you would like to hear more about my thesis in EQB.TO you can email me at mitch15jensen@gmail.com or message me on Twitter @mitchjensen_ and I can do a in depth writeup on them!

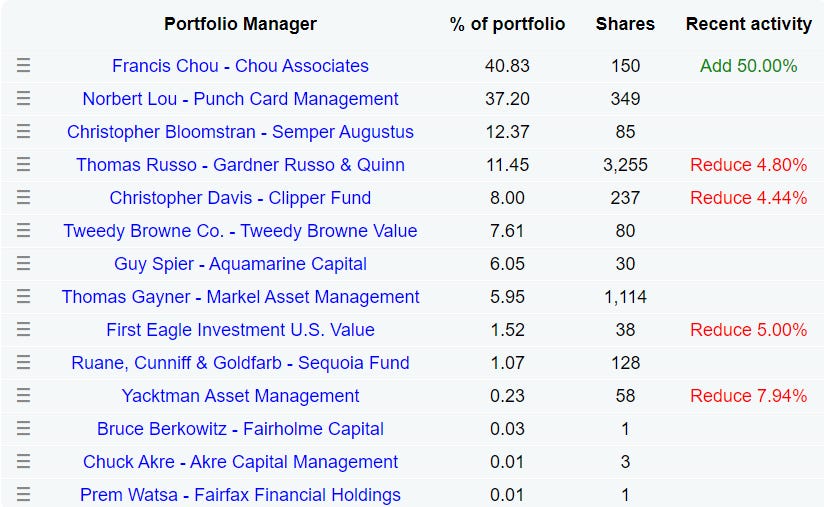

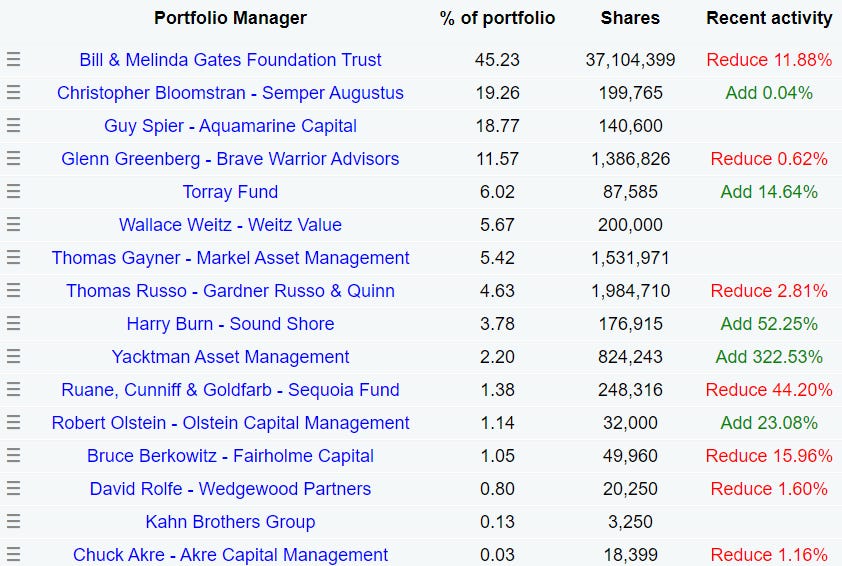

Seritage Growth Properties (SRG)

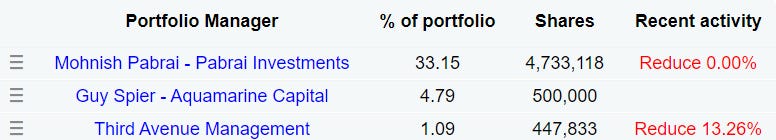

Seritage has been followed by many value investors. From Phil Towns to Guy Spier and Mohnish Pabrai to even Mr. Buffett himself owning 5% of Seritage in his personal portfolio. I started buying SRG at around $9 a share just after Pabrai and other superinvestors disclosed their position through 13F’s. Here is the list from Dataroma of the superinvestors that hold Seritage in their portfolios. (Dataroma doesn’t show Buffett’s personal holdings)

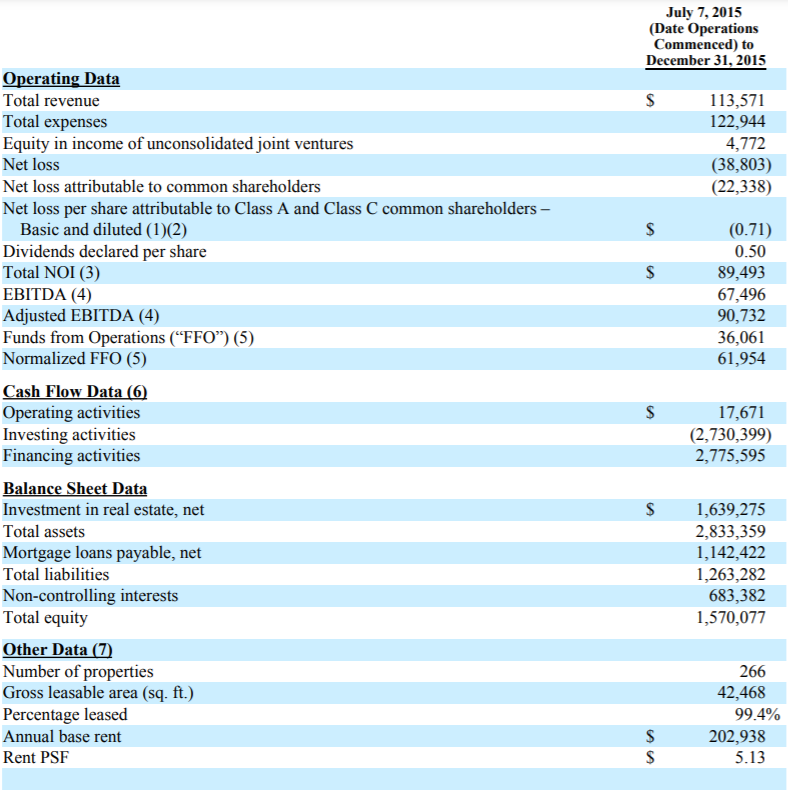

Seritage Growth Properties is a spin-off from the Sears real estate. It spun off in 2015 and had contracts with Sears to rent the real estate at decent prices back to them. The total rent PSF (per square foot) was $5.13 as of December 31st. Below is some data that was pulled from SRG’s 2015 annual report.

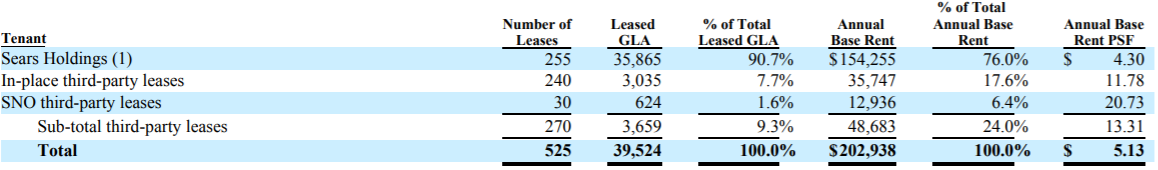

As you can see, 99.4% of SRG’s properties were leased at the time where the majority of the leases were from Sears Holdings. Below shows how much SRG’s revenue came from Sears. 76% of SRG’s total base rent was from Sears where they paid $4.30 PSF. In conclusion, SRG’s PSF rate was a great deal for Sears but not for SRG based on the PSF rate Seritage is getting today.

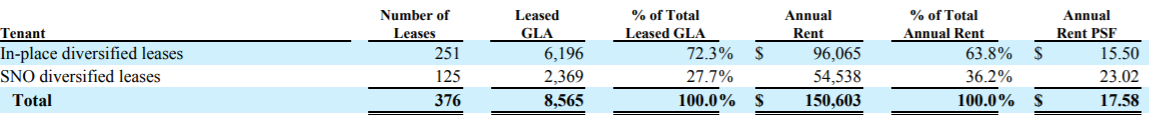

Today, SRG is in the redevelopment stages, and is “densifying” its portfolio. SRG is turning the quality commercial real estate into multi-family and mixed-use properties where they will be able to charge much higher rent than what Sears was paying in 2015. Below is the tenant overview for end of year 2020.

As you can see annual rent PSF increased from $5.13 (2015) to $17.58 today. In the latest earnings release (Q1 2021) Seritage signed 5 leases during the three months ended March 31, 2021 for 44,000 square feet at an average projected annual rent per square foot of $33.59.

Now the number of leases has dramatically decreased from 525 in 2015 to 376 today, which is based on SRG selling off the lower quality real estate and keeping the higher quality real estate to renovate and turn into beautiful properties around the country. This was just a small write-up on Seritage, I will eventually be going more into detail on later newsletters and podcasts. If you would like to know more about Seritage, I would visit Seritage’s website as well as watch some of the videos that Stock Compounder – Brad Kaellner and Investing with Tom have done on the company.

Talking Seritage Growth Properties (SRG) w/ Stock Compounder Brad Kaellner:

Talking Seritage Growth Properties (SRG) Update w/ Stock Compounder Brad Kaellner:

Boston Omaha Corporation (BOMN)

Boston Omaha is a holding company that has both subsidiaries as well as a a public and private holdings. BOMN owns a billboard company, a surety insurance business, two broadband businesses, commercial real estate, a position in Dream Finders Homes (DFH) a homebuilder that is similar to NVR where it uses option contracts, a bank, as well as an asset management business. I like to think of Boston Omaha as a young Berkshire. Now I doubt that it will compound as well as Berkshire has from 65’ until now, I do see some similarities between the two businesses. First of all, Boston Omaha is managed by what I believe to be two great managers; Adam K. Peterson and Alex B. Rozek. The B. stands for Buffett. Yes, Alex is a relative of the Warren Buffett. He is actually Buffett’s grand nephew (Warren’s sister’s grandson). Both Adam and Alex have the attributes of a young Buffett. Starting with their capital allocation skills as well as buying businesses that are quite easy to comprehend. The Co-CEO duo has done a great job allocating capital into businesses that a throwing off great returns, starting from the DFH position which they purchased a $10,000,000 stake in 2017 when it was still private. This is how the DFH investment went. “On January 25, 2021, DFH completed its initial public offering and our $10 million investment in DFH common units was converted into 4,681,099 shares of Class A common stock of DFH and one of our subsidiaries purchased an additional 120,000 shares of DFH Class A common stock at $13.00 per share in the initial public offering. The shares acquired from our 2017 investment in DFH are subject to a lockup which expires on July 19, 2021 and, due to our ownership of more than 10% of the Class A common stock of DFH, we are subject to volume trading limitations imposed by Rule 144 under the Securities Act, which can limit the number of shares of DFH Class A common stock we can sell in any 90-day period, which limitation will remain in place until such time as we are no longer deemed to own 10% or more of the Class A common stock of DFH. At March 26, 2021, our total investment in DFH, based on its closing price on such date, was valued at over $111 million. Any decrease in the value of DFH common stock before we can liquidate our holdings in DFH could materially adversely impact our operating results and our stockholders’ equity.” (2020 Boston Omaha Annual Report.) Needless to say, these two managers are other lucky or talented, and I am betting on the latter. This investment was a pretty much a pure jockey play for me. Meaning that I invested in BOMN because of the management. I did in fact buy BOMN at 1x book value which was a decent for a holding company. Currently I have not bought more of Boston Omaha as it has tripled since I initially bought, but has come back to more realistic numbers today selling at just under 2x book.

Berkshire Hathaway (BRK.B)

Berkshire needs no introduction. If you have never heard of Berkshire before I would go watch a few videos on Warren Buffett and Charlie Munger. In the mid 1800’s Berkshire Hathaway started off as a small New England textile business that solely focused on men’s jackets. In 1962 a young investor named Warren Buffett started buying up Berkshire’s stock at $7.50 a share. He was interested in Berkshire because the company was selling well below its book value which he felt that eventually the market would eventually catch on and price it properly. Buffett’s long-time partner Charlie Munger has been quoted in an HBO documentary stating that “If [the stocks] were cheap enough, he didn’t care it was a lousy company and lousy management. He knew he was going to make money anyways because of the cheapness.” Berkshire had both, a lousy business and lousy management. The President at the time Seabury Stanton has been said to have a secretary for his secretary, meaning that he spent money in places that were not needed. It wasn’t till 1964 that Buffett and Stanton came to an agreement that Stanton would buy Buffett’s shares from him for $11.50, but when the paperwork was received by Buffett, it stated that the deal was for $11.38 per share instead of the already agreed upon price of $11.50. That made Buffett extremely angry and Buffett declined the deal and proceeded to buy up 40% more of the stock, take over the company and remove Stanton. Buffett started using the company’s excess cash and investing it in businesses that he felt were cheap compared its intrinsic value that had a strong competitive advantage.

Berkshire Today

Today, Berkshire Hathaway is a holding company that has closed its textile factories and turned into a property/casualty insurance company. With the insurance premiums received, Buffett is then able to invest them into public and private companies that give him a higher return on his capital. His most notorious public investments are in Apple, Coca-Cola and Bank of America. He also owns Geico, Duracell, and Dairy Queen outright, as well as many more. Berkshire has 25 people on staff at their head office and 391,000+ more employees through their subsidiaries. Warren Buffett (age 90), the CEO and Chairman of Berkshire and his partner Charlie Munger (age 96), Vice Chairman have been working at Berkshire now for over five decades and have compounded money from $7.50 to over $420,000 per share.

Berkshire’s Subsidiaries

Berkshire’s has acquired many businesses over the years. They do so when the credit markets dry up such as in 2001 and 2008. The businesses that they are looking for are high cash-flow machines that have a strong competitive advantage over others. Examples of this would be businesses like Burlington Northern Santa Fe (BNSF) which is the largest freight railroad business in North America, and Berkshire Hathaway Energy which is the main electrical supply in Iowa. Both of these businesses have strong competitive advantages also known as a moat. Their moat is considered to be a toll bridge moat, which means that you have no option if you need that service. In the example of Berkshire Hathaway Energy, the people that live in certain parts of Iowa and want electricity going to your house, your only option is to use Berkshire Hathaway Energy for that service. As of today, Berkshire has 62 wholly-owned subsidiaries. Even though they own 62 companies, they are only in the seven industries: insurance, railroads, utilities, manufacturing, consumer products, service, and retailing. Below is a list of them the following businesses.

List of Berkshire Hathaway Subsidiaries

International Dairy Queen, Inc.

IMC International Metalworking Companies

Berkshire Hathaway Direct Insurance Company (THREE)

Berkshire Hathaway Energy Company

Berkshire Hathaway GUARD Insurance Companies

Berkshire Hathaway Homestate Companies

LiquidPower Specialty Products Inc. (LSPI)

Berkshire Hathaway Specialty Insurance

Central States Indemnity Company

Precision Steel Warehouse, Inc.

United States Liability Insurance Group

Source: BerkshireHathaway.com

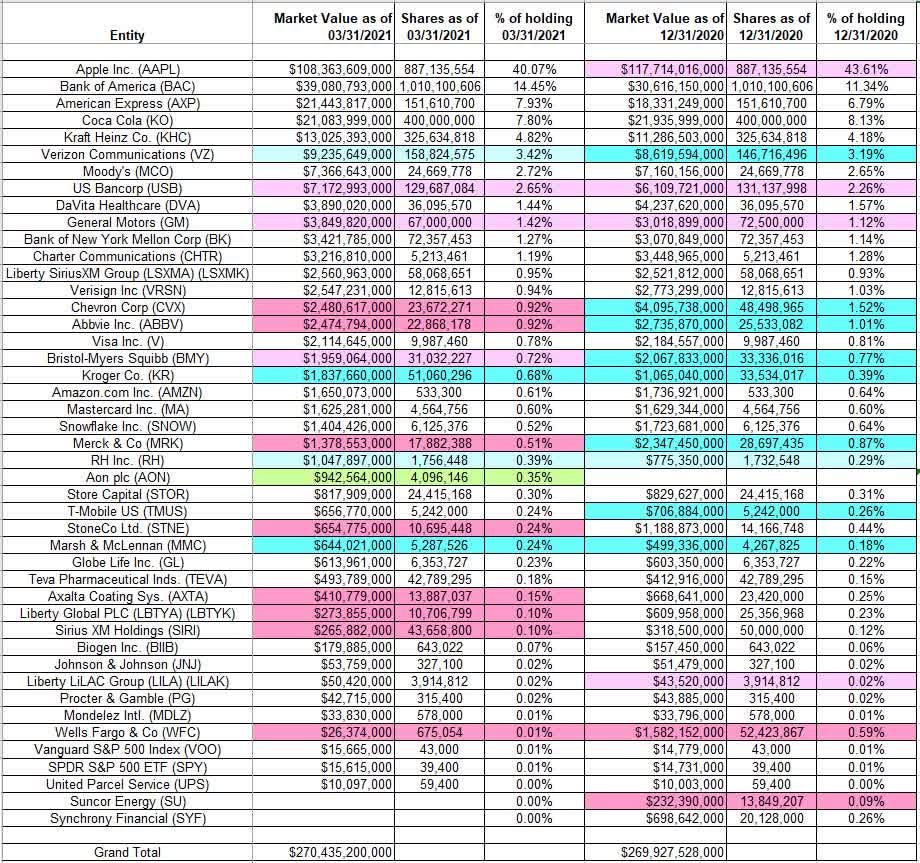

Berkshire Holdings

Warren Buffett is more well known for his public investments. Like his investments in Apple, Coca-Cola, and Bank of America, which are his top three holdings. All of these public holdings are in common stock which has thousands of other shareholders. Buffett and Munger have a very long-term approach when investing, especially in companies like Coca-Cola which they have owned since 1988. All of Buffett’s holdings are what he calls 1 ft bars which in other words means that these businesses are not difficult to understand at all. Companies like Kraft Heinz, General Motors, and Johnson & Johnson are all very simple businesses that Buffett and Munger can understand. Buffett says, “I don't look to jump over 7-foot bars: I look around for 1-foot bars that I can step over.” As of today, Berkshire has 40+ holdings, these are in many more industries than its wholly-owned subsidiaries. Below is a list of Berkshire’s public holdings.

Berkshire Hathaway Q1 2021 Holdings (03/31/21)

Source: SeekingAlpha.com - John Vincent

Even though it may look like Berkshire is quite diversified, the majority of their portfolio is in the top six stocks which makes up 79% of the portfolio. This is more of a condensed portfolio which many of the greatest investors do the same. The reason for a condensed portfolio is based on the thought that the best ideas will get the most capital, compared to a well-diversified portfolio, all holdings may only get 2% of the portfolio and may overweight a stock too much or underweight not enough. Which in the long run may have a lower return than one that is quite condensed. Having a diversified portfolio with equal weightings may seem like a smarter way to go, but it would be similar to coaching a high school basketball team and you have Lebron James as a player. As the coach you aren’t going to give equal playing time to the player that can barely bring the ball up the court and Lebron James. No, you will have Lebron on the court as much as you can because that is the smartest decision you can make to help your team win. So, if you were “coaching” a portfolio, why would you have the same amount invested in your best idea as your worst. Doing that just never made sense to me. Most of these holdings pay dividends, which gives Berkshire some added cash flow to allocate to other companies. Berkshire makes money from dividends similar to their wholly-owned subsidiaries as well as capital gains when they sell a stock for a profit.

Property and Casualty Insurance

The final part of Berkshire’s operation is their property and casualty insurance where they receive insurance premiums and can invest the float. Over the years, they have turned it into a very profitable business. Below is a chart showing the growth of the property and casualty business.

Year Float (in millions)

1970 $ 39

1980 237

1990 1,632

2000 27,871

2010 65,832

2018 122,732

2019 129,423

Source: Berkshire Hathaway 2019 Annual Report

Berkshire’s Competitive Advantage

Moats can be categorized into five types. These moats are:

1. Brand Moat (a product you’re willing to pay more for because you trust it)

Example: Coca-Cola, Apple

2. Secret Moat (a business that has a patent or trade secret that makes direct competition illegal or very difficult)

Example: Pfizer

3. Toll Moat (a business with executive control of a market – giving it the ability to collect a “toll” from anyone needing that service or product)

Example: Berkshire Energy, BNSF

4. Switching Moat (a business that’s so much a part of your life that switching isn’t worth the trouble)

Example: Bank of America

5. Price Moat (a business that can price products so low no one can compete)

Example: Fruit of the Loom

Source: Rule #1 – Phil Towns

Berkshire has all five competitive advantages through its subsidiaries and public holdings. If you are still unsure if Berkshire is a great business, just look at the superinvestors that hold BRK.A and BRK.B in their portfolio.

Berkshire’s Class A and B Shares

Berkshire has both class A and B shares. The class A shares are more expensive but have more voting rights. Right now, the Class A shares are selling for a little under $420,000. The class B shares were implemented in 1996. The class B shares are supposed to be 1/1500th of a class A share but have 1/10,000th the voting power. The class B shares are selling for around $280. Class A shares can be converted into 1500 class B shares, but class B shares cannot be converted to class A shares.

The Future of Berkshire Hathaway

Going forward as we know, Mr. Buffett and Mr. Munger will eventually no longer be with Berkshire, but they have assured the shareholders in their latest annual report to not leave once they do. The following is what they said.

Three decades ago, my Midwestern friend, Joe Rosenfield, then in his 80s, received an irritating letter from his local newspaper. In blunt words, the paper asked for biographical data it planned to use in Joe’s obituary. Joe didn’t respond. So? A month later, he got a second letter from the paper, this one labeled “URGENT.”

Charlie and I long ago entered the urgent zone. That’s not exactly great news for us. But Berkshire shareholders need not worry: Your company is 100% prepared for our departure.

The two of us base our optimism upon five factors. First, Berkshire’s assets are deployed in an extraordinary variety of wholly or partly-owned businesses that, averaged out, earn attractive returns on the capital they use. Second, Berkshire’s positioning of its “controlled” businesses within a single entity endows it with some important and enduring economic advantages. Third, Berkshire’s financial affairs will unfailingly be managed in a manner allowing the company to withstand external shocks of an extreme nature. Fourth, we possess skilled and devoted top managers for whom running Berkshire is far more than simply having a high-paying and/or prestigious job. Finally, Berkshire’s directors – your guardians – are constantly focused on both the welfare of owners and the nurturing of a culture that is rare among giant corporations. (The value of this culture is explored in Margin of Trust, a new book by Larry Cunningham and Stephanie Cuba that will be available at our annual meeting.)

Charlie and I have very pragmatic reasons for wanting to assure Berkshire’s prosperity in the years following our exit: The Mungers have Berkshire holdings that dwarf any of the family’s other investments, and I have a full 99% of my net worth lodged in Berkshire stock. I have never sold any shares and have no plans to do so. My only disposal of Berkshire shares, aside from charitable donations and minor personal gifts, took place in 1980, when I, along with other Berkshire stockholders who elected to participate, exchanged some of our Berkshire shares for the shares of an Illinois bank that Berkshire had purchased in 1969 and that, in 1980, needed to be offloaded because of changes in the bank holding company law.

Today, my will specifically directs its executors – as well as the trustees who will succeed them in administering my estate after the will is closed – not to sell any Berkshire shares. My will also absolves both the executors and the trustees from liability for maintaining what obviously will be an extreme concentration of assets. The will goes on to instruct the executors – and, in time, the trustees – to each year convert a portion of my A shares into B shares and then distribute the Bs to various foundations. Those foundations will be required to deploy their grants promptly. In all, I estimate that it will take 12 to 15 years for the entirety of the Berkshire shares I hold at my death to move into the market.

Absent my will’s directive that all my Berkshire shares should be held until their scheduled distribution dates, the “safe” course for both my executors and trustees would be to sell the Berkshire shares under their temporary control and reinvest the proceeds in U.S. Treasury bonds with maturities matching the scheduled dates for distributions. That strategy would leave the fiduciaries immune from both public criticism and the possibility of personal liability for failure to act in accordance with the “prudent man” standard.

I myself feel comfortable that Berkshire shares will provide a safe and rewarding investment during the disposal period. There is always a chance – unlikely, but not negligible – that events will prove me wrong. I believe, however, that there is a high probability that my directive will deliver substantially greater resources to society than would result from a conventional course of action.

Key to my “Berkshire-only” instructions is my faith in the future judgment and fidelity of Berkshire directors. They will regularly be tested by Wall Streeters bearing fees. At many companies, these super-salesmen might win. I do not, however, expect that to happen at Berkshire. (Berkshire Hathaway 2019 Annual Report)

The future for Berkshire is very bright in my eyes. The future management will be Greg Abel who runs Berkshire Hathaway Energy. Along with Greg, will be Ajit Jain who manages the insurance business as well as Ted Weschler and Todd Combs who will be running Berkshire’s stock portfolio. These two have already been allocating capital for a few years at Berkshire. Some of their best investments were in Apple, Amazon, and Snowflake. Both Ted and Todd have a stronger understanding of technology than both Buffett and Munger do which gives the future management an upper hand on the past management.

Conclusion

I realize that this turned out a little longer than I would have liked it, but if you want me to go further into detail for any of my holdings or any other businesses that you may be curious about you can email me at mitch15jensen@gmail.com or message me on Twitter @mitchjensen_. If you enjoyed what you read, I would appreciate it if you subscribed and if you’re interested in more content from me, head over to Money Under the Mattress podcast. We are on YouTube as well as all places where you listen to podcasts (Apple Podcasts, Spotify, Google Podcast, etc..) Here is our latest episode where we talk with Francisco Olivera about media companies. Thanks!

Disclosure

Everything written in this newsletter is NOT investment advice, it is for entertainment and educational purposes only. I may or may not have a position in the securities I mentioned, but it does not mean that I am recommending them to you. I am simply stating what I have learned and reiterating it through this newsletter. Thank you.

Thanks for sharing. Would love to hear more about BOMN

Great job Mr. Jensen: it is evident that you have come a very long way from your cannabis days. I particularly enjoyed your candor in presenting your investments. We share three great ideas in SRG, BABA and BRB. I look forward to reading more from you. 🙏🏼 thank you. Now lets go buy more BABA.